Over the last few years, property insurance carriers and lenders have asked many insureds to raise the building values of select assets. Without question this has immediate and direct ramifications for these buildings’ insurance costs (premium = rate * value), which can both be frustrating and seemingly arbitrary. Here’s some background on why this is happening and what you can do about it.

UNDERSTANDING THE TERMS “AGREED VALUE” AND “REPLACEMENT COST”

Under a property policy, the two terms “agreed value” and “replacement cost” are critical and likely familiar to those who routinely review loan covenants. Agreed value simply states that the insurance carrier consents to underwrite the property value that the insured has provided, without any applicable coinsurance provisions. Briefly, coinsurance essentially creates a coverage penalty if the carrier determines that the declared value is insufficient at the time of loss. This doesn’t apply under an agreed value structure.

The heart of the matter here is replacement cost, because it defines both the insured’s and the insurer’s responsibilities. A replacement-cost policy reimburses “the cost to rebuild or replace on the same site with new materials of like size, kind and quality.” This AFM policy definition is fairly standard across ISO and other carrier forms, and the emphasis is ours. Critically, this does not deduct any depreciation as an actual cash-value provision would. As a condition of coverage, prior to the policy term, the insured is responsible for providing a good faith estimate of the likely replacement cost for each building insured.

CONSTRUCTION COSTS HAVE SKYROCKETED

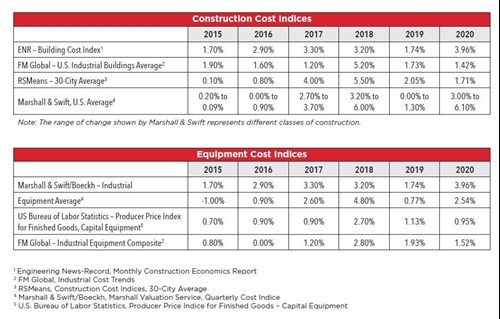

If constructing or renovating a building today at any scale, costs have skyrocketed in recent months. At last look, lumber was up roughly 200 percent year over year. Steel prices and labor costs are higher too, and this all has a direct impact on the actual cost to rebuild an existing building using new materials. If the building suffered a loss today, carriers would be on the hook for those escalated costs and, as such, now are looking for insureds to increase reported values so carriers can charge appropriate premiums. In many instances, even recent improvements may be revalued though they were built only within the last year or two, which shows how quickly the market has escalated. It’s simply more expensive to build today than even just a few months ago. This drives the carriers’ positions, unfortunately, as they tend to see their own claim/reconstruction costs increasing on a per-square-foot basis.

Many lenders also pay close attention to their collateral property valuations. A limit that may have been sufficient in the past now in fact may be underinsuring the same property given escalating costs. Similarly, many insureds have a fiduciary duty to third-party investors or even extended family members to maintain adequate insurance on portfolio properties. This also requires taking a closer look at how the property is valued.

In practice, carriers are paying more attention to this than in years past but, typically, they leave room for negotiation. Ultimately, a replacement cost is subjective to at least some degree, and stakeholders must understand the acceptable range. Most carriers use Marshall & Swift to run a benchmark report for the property, which, again, models based on today’s construction costs. They require all insureds to come within a fixed percentage of the benchmark – typically 20 to 30 percent.

We also run these reports on our clients behalf and typically use them to benchmark portfolio values. Carriers will consider a detailed counterpoint as well. It could take the form of a building replacement-cost appraisal or engaging with a third-party service such as Duff & Phelps, a valuation-service provider that most carriers accept and who provided the benchmark data below (Cost Trend Update Bulletin - March 2021). Of course, commissioning a study like this also risks producing a higher value than the one the carrier offers.

ALLOCATIONS: SPREADING THE IMPACT ACROSS A PORTFOLIO

Venbrook works with carriers to mitigate the cost impact to clients. Typically we’re successful in limiting the revaluation to small portions of a portfolio at a time, or applying nominal, “inflationary” adjustments to portfolios rather than wholesale increases in lockstep with construction-cost benchmarks. This still may cause a shock, however, when even one to three buildings see substantial increases in value, year over year, and owners pass this cost through to property-level accounting. This often leads to tenant calls questioning the swings in passed-through amounts. As always, allocations are more art than science and sometimes the impact can be spread across a portfolio.

A true blanket loss limit, without margin or so-called “statement-of-values” clauses, can be an effective tool to mitigate the risk of underreported values so long as a carrier agrees to the declared values. Most at risk in this inflationary environment are those with policy language directly limiting available policy limits to some function of declared values. With construction costs escalating at this pace, values declared at the start of a policy term may no longer be sufficient in practice.

How this affects you depends on carrier, portfolio, and the buildings themselves. We’re always available to discuss further and provide additional detail.

Download the white paper to learn more about Construction Costs and Insurable Values.

Contact me if you have questions about evaluating the cost-benefit of premiums versus coverage adequacy – two areas where potential flexibility exists within the scope of your insurance obligations.

cjames@venbrook.com | 310-571-5632

Chris James

Senior Vice President

cjames@venbrook.com

818.598.8957

Chris James is Senior Vice President for Venbrook Insurance Services and specializes in the Commercial Real Estate and Global Manufacturing business. Chris also serves as Managing Director for Pierpoint Capital Solutions, an insurance platform for large portfolios of single family dwellings and 2-4 unit multifamily assets.

Prior to Venbrook, Chris has worked for years in a broad spectrum of coverage specialties, including Public Company Directors & Officers Liability, Multinational Programs, and Large-Risk Property while with the Willis Group. Prior to entering the insurance industry, he was a management consultant in Washington, D.C., working with Fortune 500 divisional presidents, CEOs, and general managers.

Chris received a Bachelor of Arts in Mandarin Chinese and a minor in Business from Georgetown University. He speaks a variety of foreign languages, including Mandarin Chinese and Spanish.